| Afaceri | Agricultura | Comunicare | Constructii | Contabilitate | Contracte |

| Economie | Finante | Management | Marketing | Transporturi |

Economie

|

|

Qdidactic » bani & cariera » economie General aspects regarding leasing operations |

General aspects regarding leasing operations

GENERAL ASPECTS REGARDING LEASING OPERATIONS

1.1. The concept of leasing. Definition and short history of leasing

The word “leasing” comes from English from the noun “leasing” and the verb “to lease”, which could be translated in a first meaning as “to rent”

By analyzing the definitions given by different authors or international organisms we can conclude that in essence, despite some differences, they all express the same thing: the acquisition from suppliers by a specialized company (financial) of some goods and renting them to certain users (which do not dispose of financial resources necessary to purchase them directly from the supplier). The renting takes place along a certain period of time based on a contract that stipulates the payment conditions, the installment quantum, the parties’ obligations and the transfer conditions of the good in the ownership of the user, at his will.

Under a legal aspect, the leasing represents a complex contract, that allows an economical agent to obtain and use a good without paying for its counter value immediately, giving the possibility to purchase it at a residual value[1].

One of the first attempts to define leasing operations appears in French literature, definition that refers only to real-estate leasing, also called credit-bail[2]. This includes those operations through which an enterprise gives for rent immovable goods for the purpose of professional usage, with the condition, that no mater their qualification to allow the lessee to become owner of the goods.

In German literature we find an incomplete definition of leasing which establishes as single criteria in characterizing the contract, its fixed duration and the period in which the restitution of the invested capital is re-echeloned.

In Italy, the leasing (locazione financiaro) is defined in law no.183/ April 2nd 1986, as follows : the rental of movable or immovable goods, which the financer acquires, or manufactures according to the indications given by the user, the latest assuming all the risks throughout the time the contract is valid and also having the right to become the owner of the rented good, with the condition to pay the agreed price at the end of the contract. We can state the fact that there isn’t anything specified about the nature of the payments and the price.

The Belgian legislation offers the most accurate definition of leasing, through the aspect of reporting it to the economic reality of the operation, more precisely through the reserve of transmitting towards the user the risks and tasks that emerge form the usage of the good, all the elements related to the leasing operation have been stated.

In Romania, the leasing operations is defined and treated according to the stipulations of the Ordinance 51/1997, further amended and supplemented by different documents. At the moment when this document was published, the latest piece of legislation was the law 287 / 2006 approving the GO 51 / 1997 with its further modifications. According to the law, leasing as an economic operation is defined as follows:

“ leasing operations whereby a party, referred to as the lessor/financer, transmits for a determined period the right of using a good owned by it to the other party, referred to as the User, at the latter’s request, against a periodical payment, referred to as the leasing installment, and at the end of the leasing period the lessor/financer undertakes to comply with the User’s right to choose either to buy the good, to extend the leasing agreement or to end the contract relationship.“ The lessor/ User can chose to buy the respective good before the end of the leasing period, but no sooner than 12 months provided that the parties agree it and whether they pay all the obligations assumed by the contract.[3]

From an economic point of view leasing represents a source of financing in which the financer provides the necessary funds for the entire investment[4]. Through the entire period of the contract the lessor allows the user- lessee to use a certain good in exchange of the promise of the latest to pay the leasing installments.

The origins of leasing lie in ancient history of humankind. Leasing as a financing instrument registered its first versions as far back as ancient Egypt and Babylon approximately 2000 b.c.

The first written rules date back from the time of the Roman empire in 550 a.d. through the Code of Justinian, an extraordinary creation of that time[5]. We can state that leasing descends form the ancient form of credit which was represented in roman law by “fiducia”: the borrower was constituting as a warrantee for the claim the ownership of that good .There is a big similarity between leasing as a form of lease-back and the ancient form of pledge from the roman law “fiducia cum creditare” , which stated that the borrower transfers the ownership of a movable or immovable good into the patrimony of the borrower with a warranty title due to be returned once the credit is paid. The Greek philosopher Aristotle claimed that “welfare isn’t measured in ownership titles, but through the effective usage of some goods, even if they are owned by others“[6] According to some sources, the first leasing transaction is dated from 1066 when Wilhelm the Conqueror 'rented' from Normans ships for intrusion into Britain. It is also possible to find in some historical archives a mention of the first leasing agreement, the subject of which it was equipment for crusaders in 1248.

In the U.S.A., by the end of the 19th century the first operations that prefigured the leasing took place. In 1877 the telephones were rented to the customers on the basis of a contract called “lease”. In 1936 “ Safe Stores Inc.” bought a plot of land to build the superstore called “Safeway Stores” ; because movable capital was necessary he sold it to a group of investors which allowed the former owner to exploit it in lease regime for a long period of time. In the same period a similar lease-back operation took place in Ohio, the operation consisted of selling a building to a bank with a trustee title that was going to be exploited by the seller in lease regime for 99 years and after that the user had the option of purchasing the good.

Lease financing was used in the U.S. in the 1930’s for financing immovable goods. Lease financing operations evolved a lot after the 2nd World War, because of the facilities that the U.S.A. offered. In 1950 over 150 American universities were engaged in sale and lease-back transactions benefiting of multiple fiscal advantages. Equipment leasing appeared as a keen need to solve a problem. In 1950, American D.P. Bootle received a big order for which he didn’t have the necessary equipment in order to handle it. So, he decided to borrow the necessary equipment. The year 1952 is considered the beginning of modern leasing because of the creation of “United States Leasing Corporation”, the first company specialized in equipment leasing operations, which still exists today as a very powerful corporation in this area. The Californian business man Schoenfeld and D.P. Booth can be considered the “parents” of modern leasing. In 1963 the most important banking network, National Banks, received the authorization to perform leasing operations being followed by Bank Holding Companies in 1970[7]. Until 1975, in less than 15 years, banks have been authorized to perform leasing operations, directly, in 41 American states. Rapidly, this operation reached Great Britain, starting with the 1960’s, and after that, it spread in Continental Europe (France, Holland, Belgium). In Great Britain, most leasing companies were started and sustained by banks. They benefited from an extremely favorable fiscal regime. The value of the good, for instance can be deducted up to 100% of the taxable profit[8]. In 1972 The European Federation of Leasing Companies was created, called LEASEUROPE, which controls about 80% of European leasing industry . Financial leasing started to develop in the seventies in the markets of South America, Asia and Africa also. The eighties are characterized by acceptance of the concept of financial leasing practically all over the world. In 1980 after only 8 years of existence with 25 billion dollar asset it was financing a transaction system of 82 billion ECU. In the following 15 years the volume of leasing operations performed by LEASEUROPE members increased by an annual rate of 22%. In 1990 the volume of the investment financed by LEASEUROPE was approximately 94 billion ECU. By the end of 1993 LEASEUROPE had 25 affiliated countries and 1054 member institutes.

1.2. The classification of leasing operations

The diversity of leasing operations can be structured in certain classes according to the duration, parties, leasing installment related to the selling price and so on.

1. According to the weight of leasing installments in the selling price of the good :

operational leasing(maintenance): is generally short-term and is suitable for a range of assets where ownership is not required or an advantage. Such leases are generally quite expensive, but they are cancelable and free working capital that can be used elsewhere in the business[9].The leasing company assumes the obsolescence risk of the asset, is held liable for providing the spare parts and insurance and payment of different taxes and duties. Ordinarily, operating leases require the lessor, to maintain and service the leased equipment, and the cost of the maintenance is build into the lease payments. Another important characteristic of operating leases is the fact that they are not fully amortized. A final feature of operating leases is that they contain a cancellation clause which gives the lessee the right to cancel the lease and to return the asset before the expiration of the basic lease agreement[10]

|

financial Leasing : sometimes called capital leasing is differentiated from operating leasing in that it does not provide for maintenance service, it is not cancelable and it is fully amortized (that is, the lessor receives rental payments equal to the full price of the leased equipment plus a return on invested capital. In a typical arrangement the firm that will use the equipment (the lessee) selects the specific items it requires and negotiates the price with the manufacturer. The leasing company is a financial intermediary between the supplier and the user. The lessor transfers all the risks of owning the object[11] Financial leases are referred to as full payout leases as the lessor expects to recover the cost of the purchases of the asset from the lessee and make a profit[12]

2. According to the duration of the leasing contract:

short term leasing (renting, hire): represents the rental of the goods for several hours, days or months to several users with the purpose of amortization;

medium term leasing (equipment leasing): involves the amortization of the goods through consecutive rental to several users on 2-3 years term;

long term leasing(plant leasing): is frequently practiced on building market completely equipped, the duration being approximately 20-30 years.

3. According to the parties that participate to the contract:

direct leasing, where the financer is also the supplier;

indirect leasing, where the financer is a specialized entity other than the supplier[13]

4. According to the way of calculating the leasing installments:

net leasing: the installments include only the net selling price of the good, the rent including the price of usage;

brut leasing: the installments include insurance expenses, maintenance and repair costs.

5. According to the territory:

internal leasing

external leasing

There are also some special forms of leasing as in the following table:

Table 1.1: Special forms of leasing

|

Special forms of leasing |

Characteristics |

|

Lease-back |

A firm sells an asset to another party, and the party leases it back to the firm. Usually the asset is sold at approximately its market value. The firm may realize an income tax advantage if the asset involves a building on owned land[14] |

|

Experimental leasing |

The assets are to be leased on short periods provided that after the term is over the assets shall be bought by the customer if they meet the requirements or shall be returned in case of defaults. |

|

Time-sharing |

It is endorsed for economic reasons (high cost of machine tools and equipment).It is often practiced in tourism. |

|

Master Leasing |

In case of containers (trip-leasing meaning the rental on transportation period or journey period, and term-leasing, meaning term-rental). |

|

Personnel Leasing |

Its object is the rental of personnel on a short period of time (a day or several days).The leasing company is responsible for hiring the person, payment of wages and taxes according to the legislation. |

1.3. The advantages and disadvantages of leasing operations

Advantages of leasing for the beneficiary:

1. the payment mechanism through leasing installments represents an advantage for the user through the initial saving of his own capital, the payment in advance not being compulsory;

2. it doesn’t require any additional warranties;

3. it represents a perfect mean to acquire advanced technology;

4. the constant value of the rent facilitates a more rigorous programming of the expenses;

5. the opportunity of using the good even after the contract is over, lower rents are required;

6. the possibility of purchasing the good at the end of the contract at a lower price than the residual value;

7. royalty expenses paid to the leasing companies are, in developed countries, entirely deductible from the taxable profit[15]

8. leasing may sometimes be transacted at a lower rate than borrowing[16]

Advantages of leasing for the financer:

1. obtaining additional earnings through reselling or re renting of the machines that were retuned after the renting period expired;

2. maintaining the ownership rights of the goods in leasing regime being usable as warranties for new loans;

3. the acquisition costs of the goods are lower because of the volume discount the company gets for working with the same supplier[17]

4. by filling consolidated tax returns and taking advantage of the investment tax credit, financial institutions are often able to shelter substantial amounts of non-leasing income through benefits from leasing.

Advantages of leasing for the supplier (producer):

1. it is an efficient marketing technique promoting and developing exports;

2. leasing attracts new beneficiaries that can’t pay the entire price or don’t have the possibility of contracting a credit;

3. it has a promotional role in convincing the client to acquire an equipment that has been previously rented;

4. it allows the overcome of legislation difficulties[18]

Disadvantages of leasing for the beneficiary:

1. it is sometimes more costly then buying on credit – long-term expense;

2. it has restrictive conditions of maintenance, especially in the case of operational leasing;

3. the lessee doesn’t own the good. It remains the property of the leasing company during and after the lease;

4. in the case of financial leasing, the impossibility of ending the contract before the term.

Disadvantages of leasing for the leasing company:

1. the leased goods can be deteriorated through the improper usage of the beneficiary;

2. a temporary used good may no longer find solicitants (especially in the case of operational leasing);

3. it requires a large number of financial analysts, increasing the costs of transactions;

4. the difficulty of recovering a good in case of terminating the contract.

1.4. The recent evolution of the European and Romanian leasing market

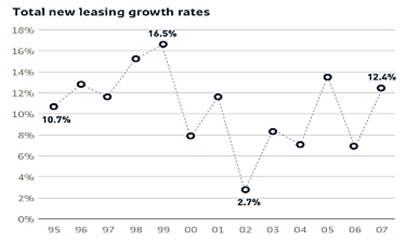

The European leasing market is in a real expansion, according to the statistics provided by Leaseurope. The European leasing market, as represented by Leaseurope, has more than tripled in size since the Federation began collecting data from its members in 1994. Growth of the market has been consistently strong overall, with the exception of 2002, where growth rates were impacted by a drop in the more volatile real estate leasing business.[19]

Graph 1.1

source: www.leaseurope.org

In terms of market volumes achieved by region/country, the UK obtained the highest one, 58 bn. Euros, followed by Germany 54 bn. Euros, Italy – 49 bn. Euros, and France 40 bn. Euros. (appendix 1.1).

Regarding individual market growth, the highest growth registered in 2006-2007 was achieved by central and eastern Europe, which increased by 50,1% compared to year 2005, while Italy had the lowest growth rate, 1,6 % compared to 2005. The rest of the regions had growth rates between 3,6 %(UK) and 16,7% (Spain, Portugal and Greece) ( appendix 1.2).

From the total equipment leasing volumes in 2007, passengers cars represented the highest percentage, followed by machinery and industrial equipment, but in terms of growth rates, the ships, rail, plane etc. sector surged by 43,1%, while the computers and business machinery plunged to a -2,3%. (appendix 1.3).

As for the major players, the weights of banks increased particularly in the top players, compared to the year 2001 and the share of those who are independent diminished. If in the year 2001, 39% of the leasing market players were independent, in 2007, only 33% are independent and in the top 20 firms by profile, 18 were bank related. (appendix 1.4).

Another indicator is really conclusive for the leasing market is called average leasing penetration rate. measured as the amount of overall new business divided by investment defined as gross fixed capital formation excluding investment in private dwellings. From 1994, which is the Leaseurope membership base year, this indicator showed a linear increasing trend in total volumes, and the growth rates increased by a relatively constant pace. In 2007, the penetration rate rose to 20.76%. When restricted to equipment (including vehicles), the penetration rate rises to 33.86% while the figure for real estate leasing is 5.41%.

Graph 1.2

Source: www.leaseurope.org

From the statistics provided by Leaseurope, in 2007, €338.9 billion of new leasing volumes were granted by the firms represented through Leaseurope’s members, a 12.4% increase compared to 2006. These members represent approximately 93% of the European leasing market.

Romanian leasing market can be analyzed through its relatively short history, concerning the fact that its first forms began at the end of 2005. The implementation of this product has been quite difficult, regarding the fact that the word “leasing” has been imported, in the conditions where the Romanian economy was characterized through a series of aspects that wouldn’t favourize in the last decade medium and long term financing. The main impediments were determined by the high levels of inflation and interest rates, together with the lack of disposable capital for medium and long-term investment[20].

The Romanian leasing market is very dynamic, and this fact is reflected through the increase in the number of leasing companies and in the volume of these operations.

In the period 2003-2007, the total asset value increased almost 4 times, from about 1 billion Euros in 2003, and reaching almost 5 billion Euros in 2007. (appendix 1.5)

By sectors, the vehicle one had the largest share in each year. It had an ascending trend during this period, almost like the total leasing market slope, only that the weight for this good segment declined over the years. If in 2003, the vehicle sector accounted for 88 % of the total leasing market, in 2007, the percentage decreased to 70% of the overall volumes, and that can be interpreted by a diversification of leasing markets and an easy increase in the other sectors. (appendix 1.6).

Regarding the players on the Romanian leasing market, the highest share is represented by banks’ subsidiary whose percentage increased from 46% in 2003 to 63% in 2007.This trend is similar with that on the European leasing market. The captives market share registered a downwards slope, decreasing with a steady rate of approximately 5% a year, reaching from 40% in 2003 to 17% in 2007.The independent players experienced a slight increase, from 14% in 2003 to 20% in 2007 (appendix 1.7).

In 2007 the volume performed by bank subsidiaries reached almost 3 billion euros, the independent players achieved almost 1 billion euros and the captive sector registered approximately 830 million Euros (appendix 1.8).

In 2008 the peak of leasing market was reported in the 2nd quarter, with a total of approximately 1.5 billion euros, consisting of 71% vehicles 23% equipment and 6% real-estate. Quarter 4 of 2008 represented a plunge in the leasing market of approximately 1 billion euros representing a 60% slump compared with quarter 2.This was due to the impact of the financial crises.

Graph 1.3

According to the customer type, on the Romanian leasing market, 89% belong to the corporate sector, 10% to retail sector and 1% to public sector. The leasing contracts are mostly signed on a 4-5 year term (33 %), while on the other side the lowest percentage of contracts are signed on a 1 year term (3%).

Compared to 2007, by the end of 2008, the total leasing market decreased by 2,6 %, from almost 5 billion euros to about 4,8 billion Euros ( appendix 1.9). Because of the financial crisis, the leasing market among many others experienced a decrease, thus the leasing companies weren’t able to fully recover their invested capital.

[1]Adapted from Clocotici D., Gheorghiu Gh., Operatiunile de leasing, editura Lumina Lex, Bucuresti, 2000, pag. 9

[2] Adapted from Giovanoli M., Le credit-bail(leasing) en Europe. Developement et nature juridique, Paris, 1980, pag. 11

[3] Government ordinance no.51/1997 approved and modified by article VII of Law No. 99/1999 Concerning some measures to accelerate the economic reform, quoted from www.alb-leasing.ro

[4]Adapted from Caras Mircea, Leasing,Ed. Enciclopedica, 1986, Puiu Alex, Tehnici de negociere contractuala si derularea in afacerile economice internationale, Ed. Tribuna Economica, 1997, pag. 229-258.

[5] Adapted from Constantinescu Coca Cornel, Leasing financiar- realitate si perpectiva, Editura Economica, Bucuresti, 2006, pag. 21

[6] Aristotle, Retorica, Book 1, chapter 5.

[7] Adapted from Andreica Marin, Andreica Cristina, Mustea-Serban Ionel, Mustea-Serban Razvan, Decizia de finantare in leasing, Ed. Cibernetica MC, Bucuresti, 2003, pag. 18.

[8] Boobyer

Chris, Leasing and finance assets-4th

edition, Euromoney Books,

[9] Punty Anthony, Dodds Collin, Financial management, method and meaning, Ed. Chapman&Hall, 1991, pag. 482

[10] Brigham Eugene, Gapensky Louis, Ehrhardt Michael, Financial management, theory and practice, Ed. The Dryden press, 1999, pag.736

[11] Adapted from Andreica Marin, Andreica Cristina, Mustea-Serban Ionel, Mustea-Serban Razvan, , Decizia de finantare in leasing, Ed. CiberneticaMC, Bucuresti, 2003, pag. 23

[12].Samuels J.M , Wilkers F.M., Brayshaw R.E., Management of company finance – sixth edition, Ed. Chapman&Hall, 1995, pag. 586

[13] Adapted from Constantinescu Coca Cornel, Leasing financiar, realitate si perspectiva, Ed. Economica, Bucuresti, 2006, pag 30

[14] Van Horne James, Wachowicz jr John., Fundamentals of financial management, Ed. Prentice-Hall Inc., 1992, pag. 638-639

[15] Adapted from Hasnas Traian, Operatiunile de leasing si contabilizarea lor, Revista “Tribuna Economica”, nr. 35/1998

[16] Rose Peter, Kolari James, Financial institutions, Ed. Irwin, 1995, ch. 23, pag 699

[17] Adapted from Achim Monica, Leasingul-o afacere de success , Bucuresti, Ed. Economica, 2005, pag.50

[18] Adapted from Negrus M, Finantarea schimburilor internationale. Politici. Tehnici., Ed. Humanitas, Bucuresti, 1991, pag. 141-144

[19] Market trends and research, Facts and Figures, www.leaseurope.org

[20] Adapted from Constantinescu Coca Cornel, Leasing financiar, realitate si perspectiva, Ed. Economica, Bucuresti, 2006, pag 52

| Contact |- ia legatura cu noi -| | |

| Adauga document |- pune-ti documente online -| | |

| Termeni & conditii de utilizare |- politica de cookies si de confidentialitate -| | |

| Copyright © |- 2025 - Toate drepturile rezervate -| |

|

|

|||

|

|||

Esee pe aceeasi tema | |||

|

| |||

|

|||

|

|

|||